World Bank, firm team up to promote SDGs through innovative finance

The World Bank (International Bank for Reconstruction and Development or “IBRD”, rating Aaa/AAA) is pleased to announce that it has teamed up with BNP Paribas to promote the Sustainable Development Goals (SDGs) through an investment solution being developed for institutional and retail investors around the world.

The aim of the initiative is to launch a program of equity index-linked World Bank bonds to allow investors to support and benefit from the global ambition set by the United Nations 2030 Agenda for sustainable development and the Sustainable Development Goals. The performance of the bonds will be linked to the performance of the Solactive Sustainable Development Goals World Index, which consists of eligible companies, based on Vigeo Eiris’ Equitics research, which maps the SDGs against the included companies’ products, services and behaviors.

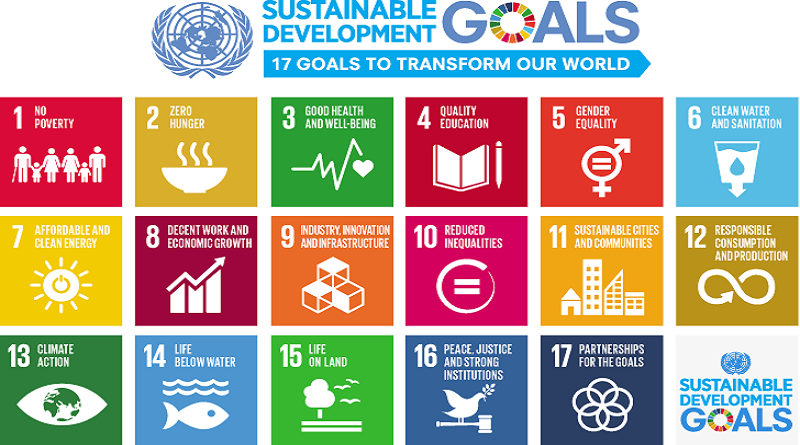

The SDGs are a set of 17 interlinked goals established to guide international cooperation to achieve sustainable development, end poverty, build peace and tackle climate change. They were adopted by United Nations member countries in September 2015 and require active participation from governments, corporations and investors in all countries. The global goals promote clean water and sanitation, health, sustainable industry and infrastructure, affordable and clean energy, education, gender equality and much more. They are designed to help every individual and every community harness the benefits of development through peace, partnership, prosperity, people and planet.

“The United Nations Secretary-General recently launched a Financial Innovation Platform (FIP) to facilitate private sector engagement with the 17 Sustainable Development Goals. This new partnership by the World Bank and BNP Paribas is exactly the kind of initiative that the platform seeks to encourage,” said David Nabarro, Special Advisor on the 2030 agenda, Executive Office of the Secretary-General, United Nations.

“Achieving the Sustainable Development Goals will require increased collaboration from public sector, private sector, and individuals. The World Bank’s twin goals – eliminating extreme poverty and boosting shared prosperity – are aligned with the SDGs. By buying World Bank bonds, investors have the opportunity to support companies in a way that supports sustainable development,” said Arunma Oteh, Vice President and Treasurer, World Bank.

The new product will allow investors to contribute to the financing of sustainable development projects through the use of proceeds of the World Bank bonds and to benefit from the performance of the companies in the SDG index. The initiative will also raise awareness among the financial community of the various roles the private sector can play in supporting the achievement of the SDGs nationally and internationally. For example, investors can align their investment strategies to the SDG framework, banks can design innovative products supporting corporates aligned with the SDGs, and index providers can filter companies based on their contribution to the goals.

The initiative also highlights the World Bank’s overall sustainable development mandate and focus on working with its member countries to achieve a positive development impact for all projects. To achieve its twin goals to eliminate poverty and boost prosperity the World Bank is positioned to use financing, robust data and innovative products to help countries grow, invest and insure for the future.

“We are proud to be part of this initiative with the World Bank in support of the Sustainable Development Goals. This effort is in direct response to the UN Secretary-General’s launch of a Financial Innovation Platform (FIP) that calls for innovations and new financial models in support of the SDGs. Through this innovative program, we can help our clients meet their increasing need to align financial objectives with global sustainability objectives. Sustainable finance is one of the key pillars of our business and this partnership around the global goals is an important new development for us in this space,” said Olivier Osty, Executive Head of Global Markets, BNP Paribas.

“Solactive has been very active in the development of indices that meet the needs of an increasing number of ESG-conscious investors. With the Sustainable Development Goals Index series, Solactive is providing the basis for investment products that mirror the UN’s SDGs. As such, our contribution to the World Bank-BNP Paribas equity-linked bonds represents an important milestone for Solactive,” said Steffen Scheuble, CEO of Solactive AG.

“We are extremely pleased to be part of this initiative promoting investments in support of projects driving sustainable growth. This equity linked World Bank bonds program is a smart and secured solution for investors and a milestone on the road to supporting the SDGs,” said Nicole Notat, CEO at Vigeo Eiris.